Budget FAQs

Boulder Rural derives its income from the property taxes paid to the district by its residents. Boulder Rural does not receive any revenue from the City of Boulder or from any sales taxing authority. The total (market) value of each property in the county is determined by the Boulder County Assessor’s office. The total value of each residential property is reduced to its assessed value by the criteria established by the Gallagher Amendment, a law passed by referendum in 1982 (see the Gallagher Amendment description below). Since 2005, the Gallagher Amendment percentage has been 7.96%, meaning that the assessed value of a residential property in the District is 7.96% of its total value. So, if you own a $400,000 property in Boulder County, its assessed value is $31,840. In 2018, this assessment multiplier is going to be reduced from 7.96% to 7.2%. This will reduce the assessed valuation of a $400,000 property to $28,800.

In 1982, the voters of Colorado approved an amendment to the Colorado Constitution, which included the “Gallagher Amendment.” One of the intents of this amendment was to stabilize residential real property’s share of the property tax base at 45% of all property taxes. Since 1985, in every odd year, all the assessors in the state have computed the residential and the non-residential assessments in their respective counties. The numbers are added up and the Gallagher percentage is computed to set the residential real estate share at 45% of the total. That percentage is used for the next two years as the Assessment Rate in the computation of your property taxes.

Over the years, the result of this amendment has been to reduce the ratio between the assessed value of a residential property and its market value. In 1982, before the Gallagher Amendment, residential real estate was assessed at approximately 30% of market value. In 1983, as a result of the Gallagher Amendment, that percentage dropped to 21%. By 2001, the assessment rate had dropped to 9.15% of market value; in 2003, it dropped to 7.958%; and in 2005, for the first time in its history, it rose very slightly to about 7.960%. For 2018, the Gallagher Amendment will reduce the assessed valuation multiplier to 7.2%.

The amount of tax each property owner pays to each taxing entity (e.g., Boulder Rural) is determined by multiplying the property’s assessed value by the mill levy for that entity. Boulder Rural’s mill levy has been 15.747 since 2016. Therefore, the owner of a $400,000 home will have paid annually $31,840 × 15.747 ÷ 1,000 = $501.38 in property taxes to Boulder Rural. In 2018, the owner of that same $400,000 house will pay $453.51.

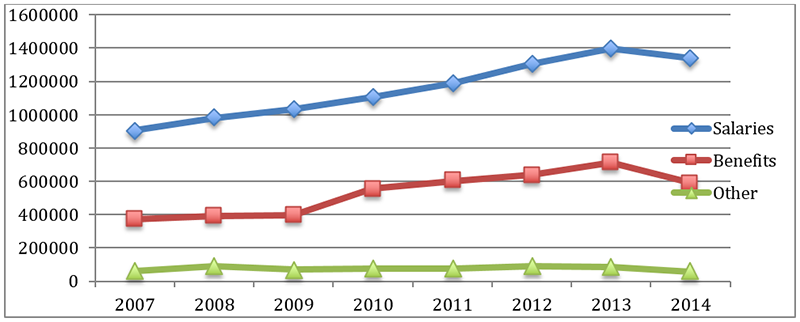

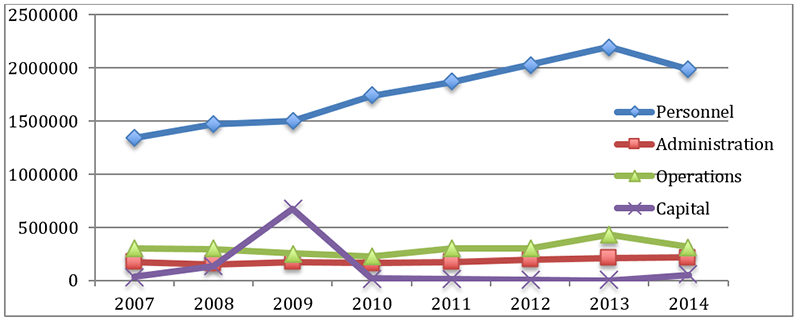

Boulder Rural’s expenditures are separated into four categories in our budgeting process. They are Personnel, Administration, Operations, and Capital. The personnel category includes salaries, benefits, and other personnel costs. The administration category includes professional fees (bookkeeping, auditing, legal); office expenses, and IT support. The operations category includes the costs of running a fire department (apparel, repairs and maintenance, fire stations, and training). The capital category includes the cost of major purchases such as vehicles, radios, and safety and medical equipment.

As you can see from the chart below, the largest of these four categories is personnel. Administration and operations costs are straightforward and predictable. Capital expenditures go up and down with major expenditures, such as the fire engine purchased in 2009.

The chart below shows the three subcategories of our personnel expenses. It demonstrates how our benefit expenses have increased over the years, principally as a result of increasing medical and dental insurance costs.